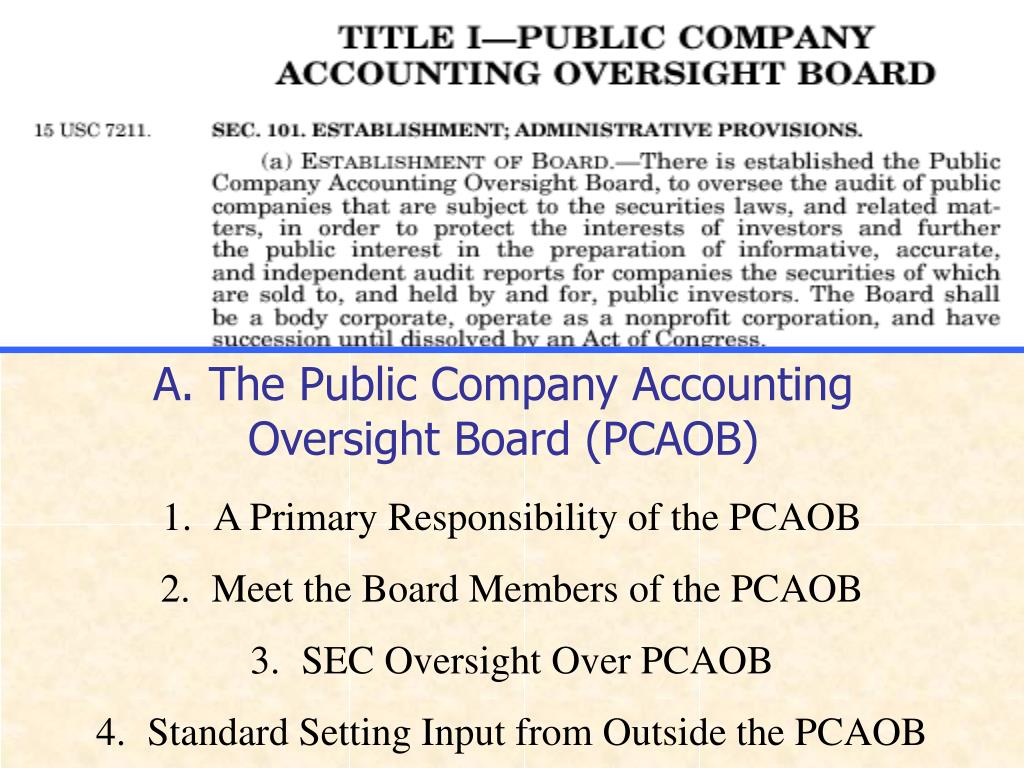

Meanwhile the PCAOB has been stymied since its launch in 2002 by the inability to inspect and access the working papers of auditors reporting on enterprises in China.The agency was played like a chump in its 2015 smoke-and-mirrors “ settlement” regarding enforcement subpoena responses by the large accounting firms.The wave of reverse mergers by which Chinese companies gained access to US listings in this century’s first decade caught the SEC on the back foot.My own views are well recorded: American policy toward Chinese companies has been incoherent and inconsistent for years, most recently with the Holding Foreign Companies Accountable Act of last year, with its can-kicking three year extension before Chinese companies with uninspected auditors might face de-listing. It will be a test of the policy and enforcement commitment of these erstwhile gate-keepers. The American regulators –- the Securities and Exchange Commission and the Public Company Accounting Oversight Board –- might actually buy this remarkable assertion of restored corporate virtue. With the echoes still ringing from China-based Luckin Coffee’s $ 300 million accounting scandal in 2019, the company is reportedly planning to relist its shares in the United States.

0 kommentar(er)

0 kommentar(er)